Debt characteristics

Prudent financing preferences

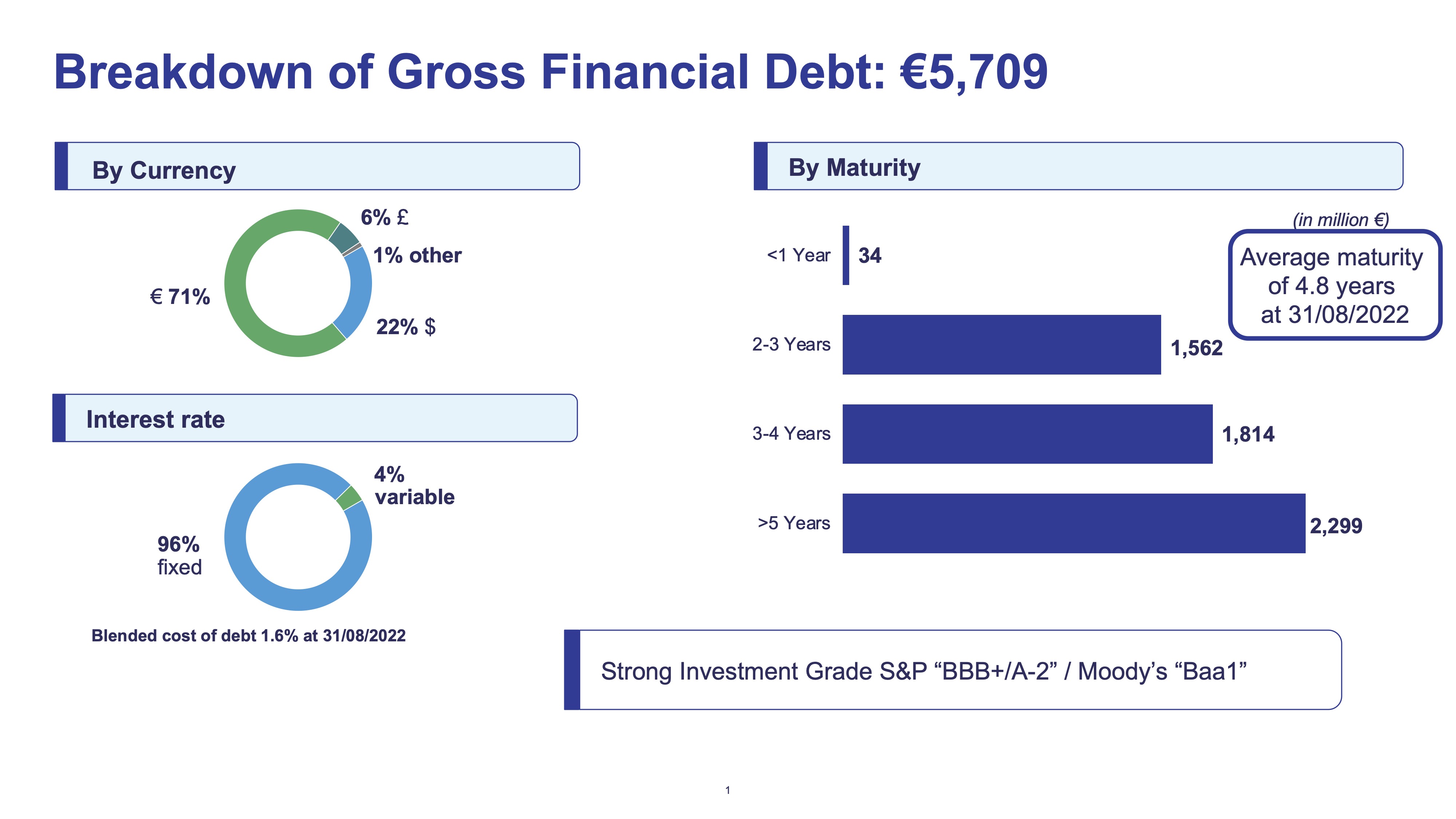

- Diversification of funding sources and debt maturities with a strong historical skew towards debt markets and long term funding

- Skew towards borrowing at fixed interest rates

- Hedging of all foreign exchange risk on internal loans

- Prudent liquidity management through the back up of commercial paper issuance with strong long term credit lines

- Cash centralisation through Sodexo Finance DAC’s international cash pooling and diversification of investments to mitigate the counterparty risk

Download the accessible transcript

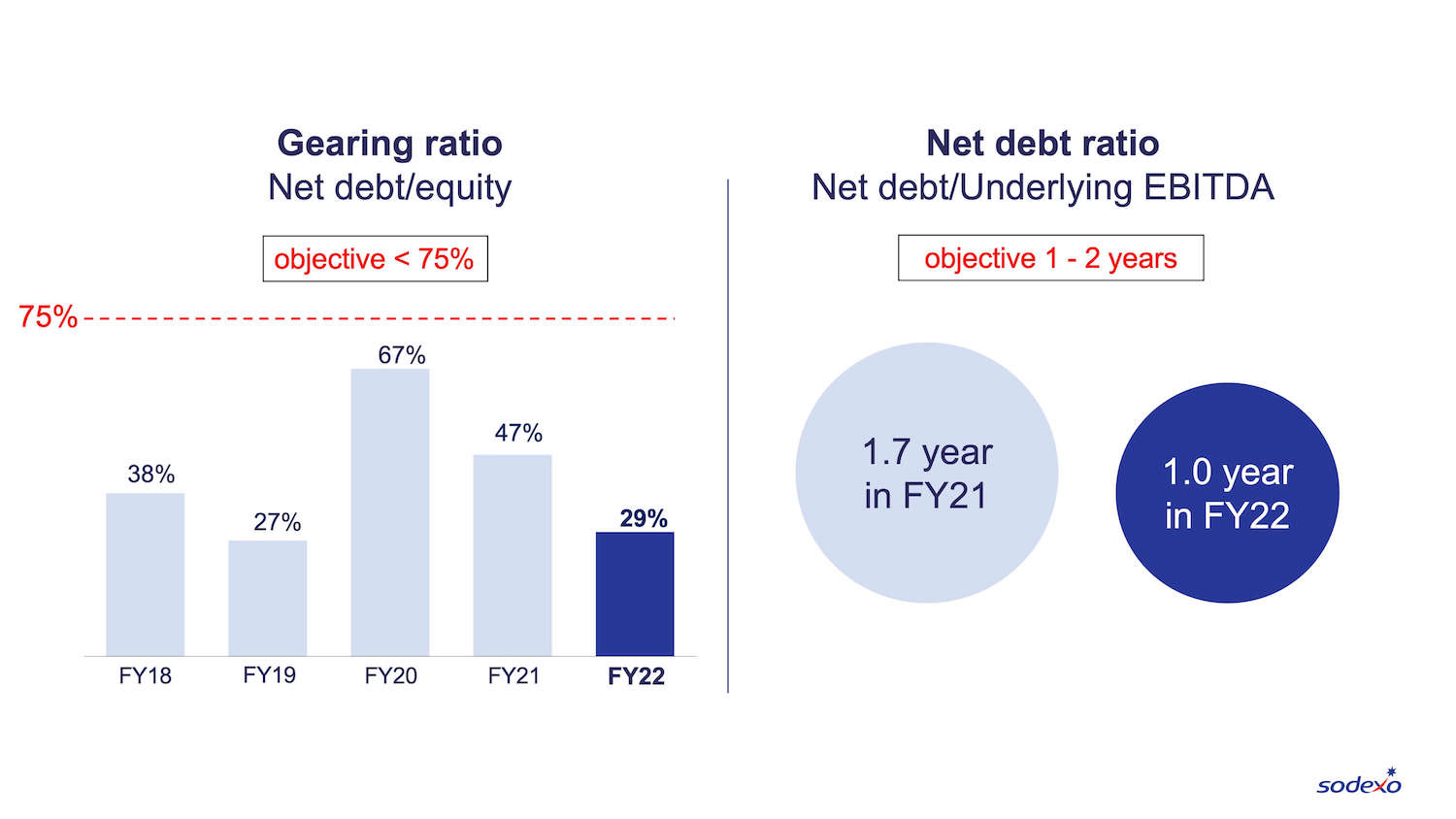

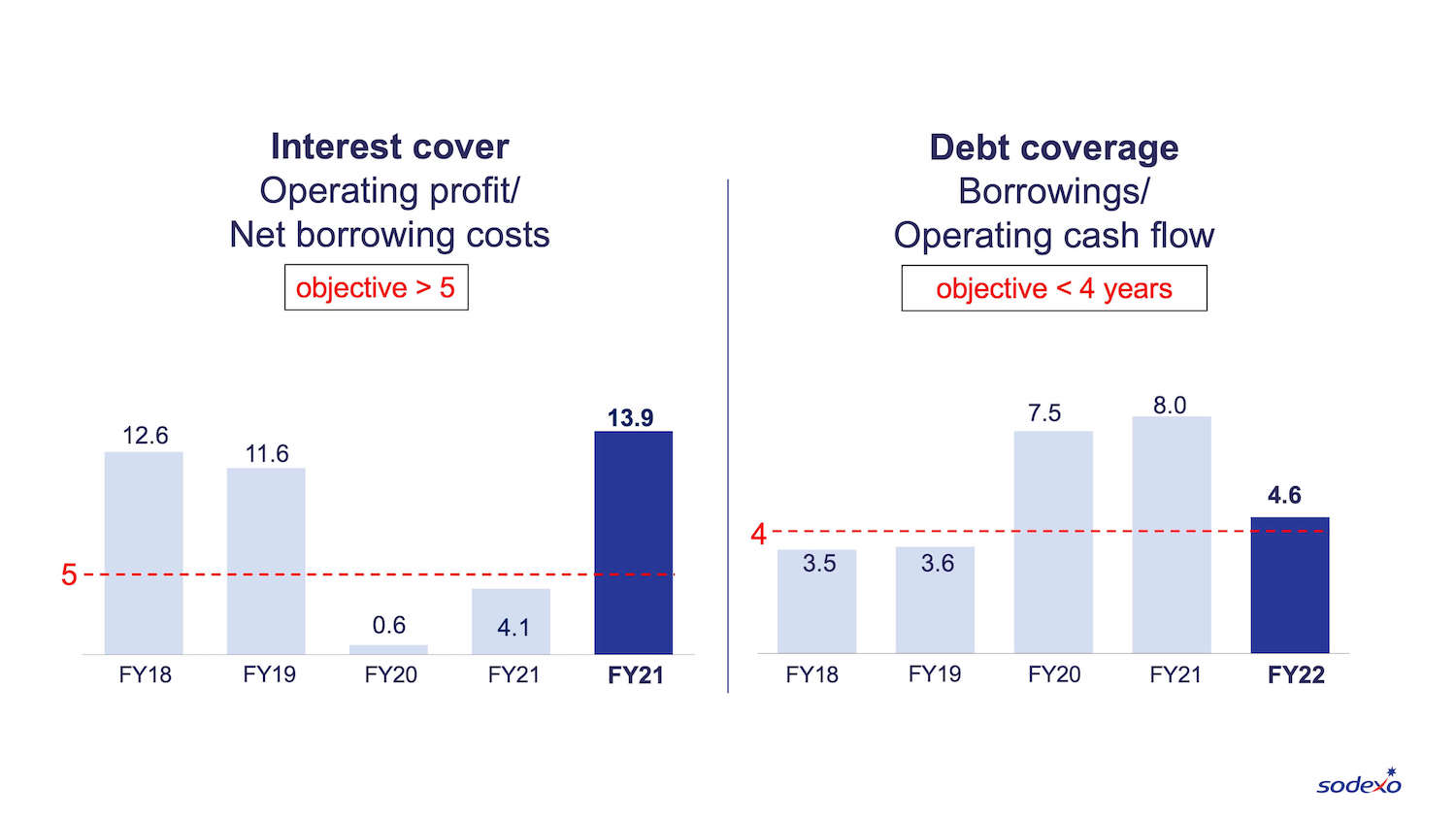

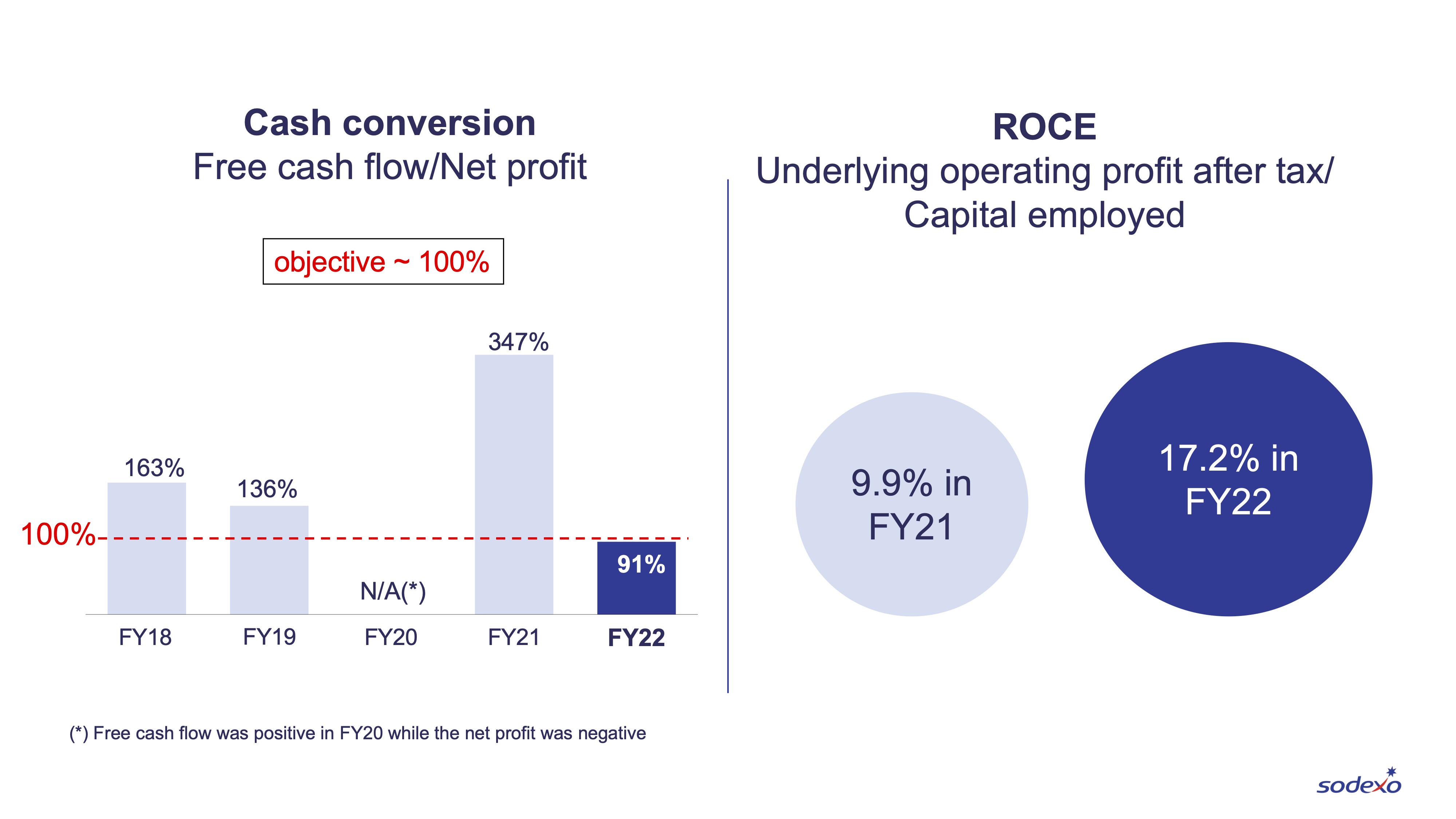

Main ratios

Download the accessible transcript

Diversified financing sources, including links to ESG commitments

Sodexo is a frequent issuer of Euro bonds in the capital markets, it had its first Sterling issuance in June 2019 and an inaugural US bond market issue in April 2021.

Sodexo is an issuer of Negotiable European Commercial papers (NeuCP) to facilitate short term funding needs and can access a Syndicated credit facility and Bilateral credit facilities, all with its core bank partners as back up.

The Syndicated credit facility for €1.4bn was negotiated in July 2019 with a maturity date of July 2024, and has been extended up to July 2026. This facility also includes a sustainability clause that links the credit facility cost to Sodexo’s ability to achieve its Better Tomorrow 2025 objective to reduce food waste by 50%. The bilateral credit facilities provide the remaining €450m of undrawn liquidity. As of August 31, 2022, these back up lines were undrawn and totalled €1.8bn.

Credit rating

Sodexo regularly meets its three rating agencies.

| Agency | Entity | Date | Short term rating | Long term rating | Outlook | Report |

|---|---|---|---|---|---|---|

| Moody's |

Sodexo SA | 28 April 2022 |

None |

Baa1 |

Stable | |

| S&P |

Sodexo SA | 17 february 2023 |

A-2 |

BBB+ |

Stable | |

| S&P | Sodexo Finance DAC | 17 february 2023 |

A-2 |

BBB+ |

Stable | |

| Qivalio (ex-Spread rating) | Sodexo Finance DAC | 05 May 2022 |

SR-1 |

NA |

NA |

Since Sodexo was initially rated by S&P in March 22 1995, Sodexo long term rating was stable at BBB+ up to January 2014 when it was upgraded to A-. The recent Covid 19 crisis has impacted Sodexo’s S&P rating with a downgrade back to BBB+ in April 2021.

In April 2021, Sodexo attained its first Moody’s rating of Baa1.

Sodexo’s financing vehicle, Sodexo Finance DAC

Sodexo Finance DAC is wholly owned by Sodexo SA, based in Dublin and became an internal financial holding in 2017. It is the primary internal financing vehicle for intercompany structures, cash pooling and cash management and also issues commercial papers guaranteed by Sodexo SA.